If you’re enrolling in or making changes to a group life insurance or disability plan, you may be asked to complete Evidence of Insurability (EOI), sometimes referred to as a Statement of Health.

- What is Evidence of Insurability (EOI)?

- When is EOI required?

- How do I know if I need to complete EOI?

- How do I submit Evidence of Insurability to a carrier?

- What is a Guaranteed Issue amount?

- What happens after I submit an EOI application with the insurance carrier?

What is Evidence of Insurability (EOI)?

Evidence of Insurability (EOI) is a health questionnaire that helps your insurance carrier determine whether you qualify for new coverage. This commonly requires answering a few simple health questions to determine if you meet health standards for requested insurance. An underwriter reviews the application to make a final approval for that coverage.

When is EOI required?

Insurance carriers usually request that you submit an EOI application when you (or a dependent) request to enroll in a coverage volume that is above a certain amount - typically known as the Guaranteed Issue (shown as the pre-approved amount in Maxwell).

Example: You elect to enroll in Voluntary Life for a total coverage amount of $250,000, but the carrier’s pre-approved amount (Guaranteed Issue) is $100,000.

You can be enrolled for $100,000 right away, but will be required to submit EOI to the carrier before you are able to be covered by the additional $150,000.

| Pre-Approved | Pending EOI Approval | Total Requested Amount |

| $100,000 | + $150,000 | = $250,000 |

Also, if you are requesting an increase in current coverage, or you choose to elect coverage after previously declining, you may be required to submit EOI (this is known as late entry).

To sum it up, you may be prompted to provide evidence of insurability to your carrier if:

- you apply for a coverage amount that is more than the guaranteed issue or pre-approved amount.

- you previously enrolled in the benefit and now want to increase your amount of coverage.

- you declined the benefit during your initial enrollment opportunity and now want to enroll in coverage.

How do I know if I need to complete EOI?

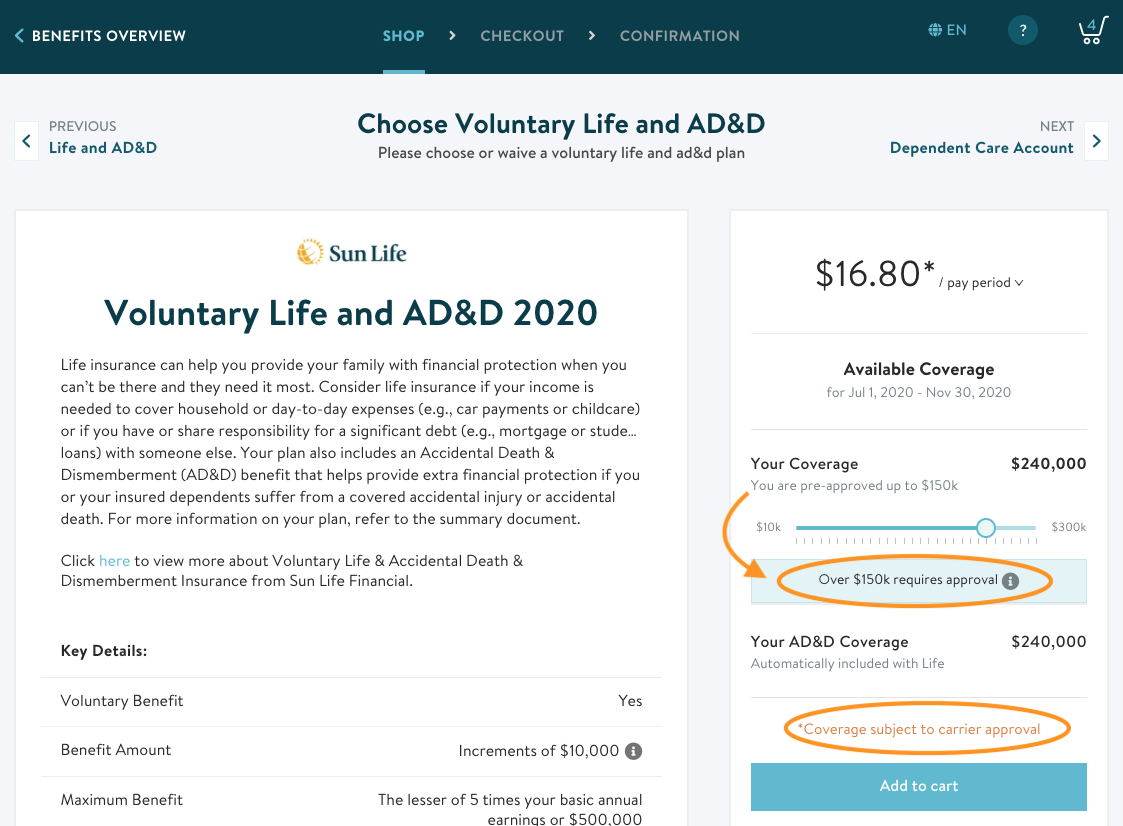

In Maxwell, you’ll see the pre-approved amounts during shopping and we’ll let you know if any amount is subject to additional carrier approval. That means it will require you to submit EOI.

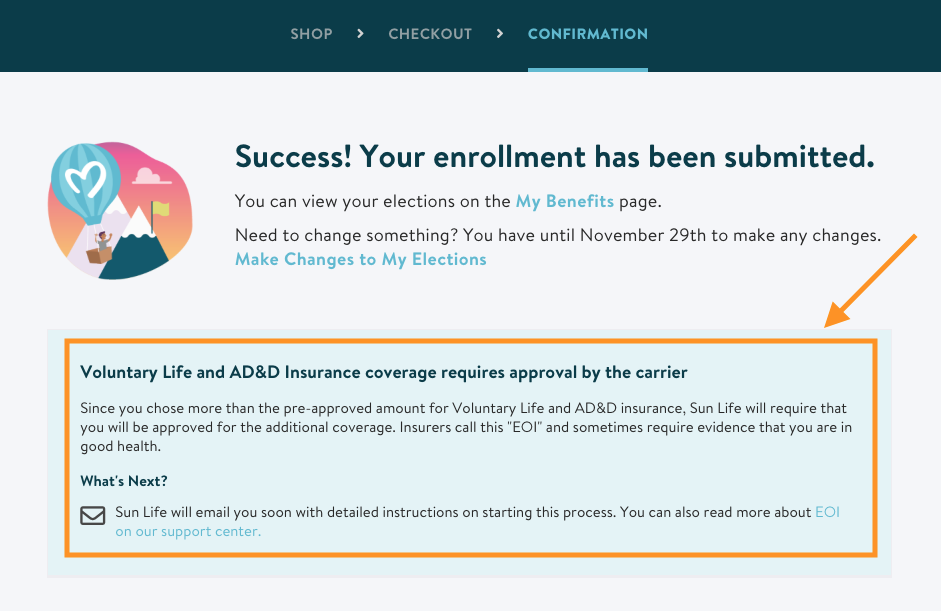

Also, pay special attention to your confirmation screen when checking out. You’ll see a note alerting you that you need to complete EOI with your carrier:

How do I submit Evidence of Insurability to a carrier?

If you’re requesting an amount that requires EOI, you must complete an EOI application from your insurance carrier. This is typically done either online or by paper and varies by carrier. If you have additional questions on how to submit, please reach out to your employer for more information on your specific carrier’s requirements.

What is a Guaranteed Issue amount?

A Guaranteed Issue amount, sometimes shown as the “pre-approved” amount in Maxwell, is the amount of coverage you can elect without having to provide additional health information (EOI) for approval. This means you won’t be turned down for medical reasons if you elect an amount of coverage up to the Guaranteed Issue amount.

The Guaranteed Issue amounts and deadlines vary according to your policy and the type of coverage. When in Maxwell, pay attention to the pre-approved amounts that show as you shop for benefits.

Please Note: If you see $0.00 as pre-approved, this means the full amount you requested requires EOI be submitted to your carrier for approval.

If you have additional questions, please ask your employer for more information.

What happens after I submit an EOI application with the insurance carrier?

The insurance carrier will review your application and contact you with a decision. You will either be approved, asked for more information, or denied the additional amount of coverage.

If you are denied, the amount of coverage you’re enrolled in up to the pre-approved amount will remain.